Financial Planning for Your Career Growth: Mostly young people or youngsters, feel overwhelmed and on the top of the cloud when they just started their career or got their first job. Lot of money influx in their bank account and wallet with not much of liability, makes them happy and cool among friends.

At this stage, family responsibilities are very minimal, which allows you to spend your income mostly on your interests. With this financial freedom, there is a strong temptation to indulge in the latest gadgets and other expensive or exclusive items.

At this time, most people focus mainly on the present, ‘today’, with little consideration on financial planning for the future goals and career path or career growth. Even, many people after gaining experience don’t bother about the financial planning, till the time expense monster 👹 knocks their door!

Saving, for many, is a tough task. It seems complex and intimidating, especially for young professionals. Managing expenses and savings becomes a tricky affair.

At this point of life, a young individual or an experienced professional, may grapple with important questions like

- “Why is financial planning necessary?” or

- “Why bother about retirement, when it’s years away?”

More than simply developing your professional abilities is needed to navigate a successful career; you also need to make wise financial decisions in order to safeguard your future and maintain stability throughout your career.

Every individual should keep these goals in mind, either you are in early phase of your career or after becoming an experienced professional! Your focus shouldn’t be just on your present life, but you should also work on your future plans.

You should start early in saving, while creating a consolidated base for your future career goals and other goals, before an emergency hits you.

This in-depth guide will cover every facet of financial planning, specifically for your career path and job path, giving you priceless information to support wise financial choices.

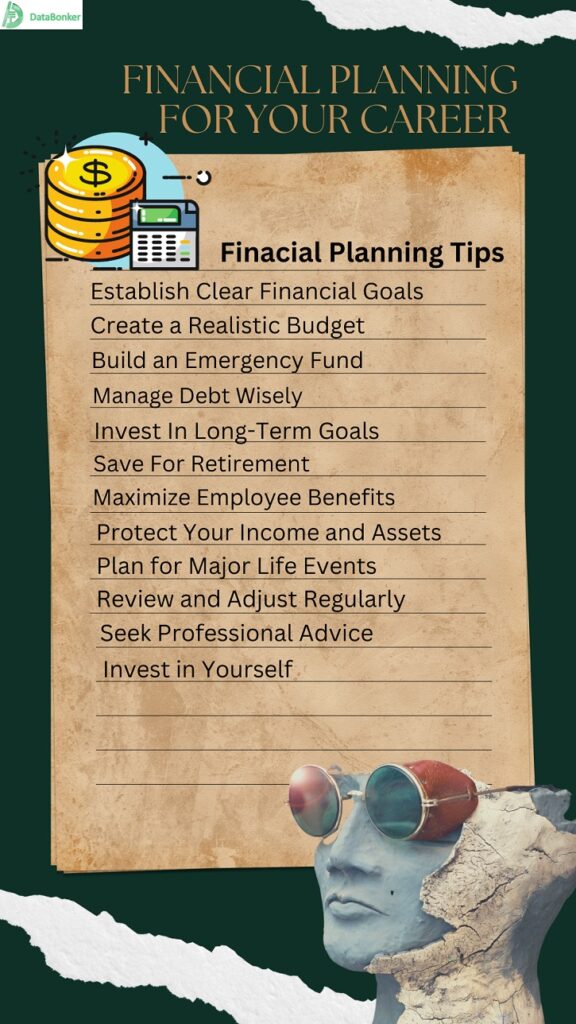

Table of Contents

- 1. Establish Clear Financial Goals

- 2. Create a Realistic Budget

- 3. Build an Emergency Fund

- 4. Manage Debt Wisely

- 5. Invest In Long-Term Goals

- 6. Save For Retirement

- 7. Maximize Employee Benefits

- 8. Invest in Yourself

- 9. Protect Your Income and Assets

- 10. Plan for Major Life Events

- 11. Review and Adjust Regularly

- 12. Seek Professional Advice

- Conclusion

1. Establish Clear Financial Goals

Any sound financial strategy must start with the establishment of clear, attainable financial goals. These goals provide you with a crystal-clear feeling of direction and inspiration to handle your money well.

Your objectives may include a variety of dreams, such as raising a family, paying for your children’s school, or amassing a sizeable retirement fund.

2. Create a Realistic Budget

A budget is an essential component of sound financial management and success, not just a tool for managing money. Tracking your income and expenses carefully will help you better understand your financial status.

Organize your spending into two categories:

- Necessities (such as housing, food, utilities, and transportation) and

- Non-necessities (such as upscale eating, entertainment, and luxury items).

Set aside your salary for savings and investments with the intention of prioritizing your financial stability.

3. Build an Emergency Fund

Because of how unpredictable life is, unforeseen expenses might happen at any time. It is crucial to start an emergency fund for this reason. This fund serves as a safety net by typically covering three to six months’ worth of living expenditures.

It gives you peace of mind by guaranteeing that you are ready for unanticipated events like medical emergencies, auto repairs, or even an unexpected job loss.

4. Manage Debt Wisely

Debt management can be difficult, particularly when it comes to student loans, credit card debt, and mortgages. Make paying off high-interest debt your top priority in order to achieve financial stability. Spend additional money on these obligations to hasten their cancellation.

Consider debt consolidation tactics to simplify your payback procedure and look at refinancing possibilities to get lower interest rates.

5. Invest In Long-Term Goals

In particular, investing can help you achieve long-term financial objectives like retirement or paying for your children’s college education. Consider implementing a diverse investment strategy that matches your risk appetite and long-term goals if you want to maximize your financial success.

Look at several investing possibilities, including equities, bonds, homes, and retirement accounts. By beginning your financial journey early, you can take advantage of compounding gains.

6. Save For Retirement

It’s never too early to start saving for retirement, regardless of where your career is in the process. Retirement Planning should be essential part of your Financial Planning Process.

If you are someone from the USA – You can Utilize 401(k) and IRA employer-sponsored retirement plans to the fullest extent possible.

- What is 401 k plan – A 401(k) is a tax advantage retirement savings plan. It is sponsored by an employer, which allow employees to contribute a part of their pre-tax income. The employee earnings in the 401(k) account doesn’t attract tax, till the time of withdrawal at the time of retirement.

- What is IRA – IRA is an Individual Retirement Account in United States (US). It is a retirement savings account, which allow US individuals to contribute and invest money for their retirement. IRA plan offers them tax benefits. IRA account can be opened with a financial institution or brokerage firm.

There are several different types of IRAs –

- Traditional IRA,

- Roth IRA, and

- SEP IRA.

Other countries may have similar retirement savings accounts with different names and structures. There may be similar or different rules and regulations with respect to retirement accounts governing body and jurisdictions.

Some of other countries equivalent ‘Retirement Savings Plan and Account’ are –

- Canada:

- Registered Retirement Savings Plan (RRSP)

- Tax-Free Savings Account (TFSA)

- United Kingdom:

- Individual Savings Account (ISA)

- Self-Invested Personal Pension (SIPP)

- Australia:

- Superannuation Fund

- New Zealand:

- KiwiSaver

- Poland:

- Individual Pension Security Account (IKE)

- Japan:

- Employees’ Pension Insurance (Kosei Nenkin)

- India:

- Employees’ Provident Fund (EPF), Pension Plan

- Public Provident Fund (PPF)

- France:

- Plan d’Épargne Retraite (PER)

- Assurance-vie

- Spain:

- Plan de Pensiones

- Germany:

- Riester-Rente

- Portugal:

- Plano de Poupança Reforma (PPR)

- Netherlands:

- Algemene Ouderdomswet (AOW)

- Pensioenfonds

- Belgium:

- Pensioensparen (Pension Saving)

- Groepsverzekering (Group Insurance)

- South Africa:

- Retirement Annuity Fund (RAF)

- Pension Provident Fund (PPF)

Note: Please note that the specific details, regulations, and structures of these plans may vary, according to country’s policy. It is always advisable to consult with financial advisors or local authorities for accurate and up-to-date information.

These plans can help you a lot in your retirement planning. If your employer matches your contributions, think about increasing them, as it’s essentially free money for your retirement. A financially secure retirement time can be achieved by regular and early retirement savings.

7. Maximize Employee Benefits

Knowing the perks that your employer offers is crucial for maximizing your financial resources.

Health insurance, dental care, retirement plans, and occasionally even stock options or profit-sharing plans are among these advantages. These employee benefits are made for your convenience and ease out extra burden on you. Take full advantage of these opportunities because they can have a big impact on your overall financial security.

8. Invest in Yourself

Your education and talents are priceless assets that have a direct bearing on your ability to generate money. Think about spending money on further training, credentials, or courses that can improve your credentials and create new employment options.

Long-term income potential from these investments makes them significant elements of your financial plan.

9. Protect Your Income and Assets

In order to protect your financial security, insurance is essential. To safeguard your health, life, and property, think about getting policies like health insurance, life insurance, disability insurance, and renters’ or homeowners insurance.

You can avoid financial setbacks by having adequate insurance coverage, which guarantees you have a safety net in case of unforeseen catastrophes.

10. Plan for Major Life Events

A crucial component of financial planning is preparing for significant life transitions. Events like getting married, having kids, buying a house, or going back to school can have a big impact on your financial circumstances. To account for these milestones and make sure you are financially ready for the changes they bring, adjust your savings targets and budget.

11. Review and Adjust Regularly

The process of financial planning cannot be set and forgotten. It must be reviewed and modified on a regular basis to remain effective.

Review your financial objectives and budget often as your job develops and your circumstances change to make sure they still reflect your desires and circumstances. By regularly reviewing your financial plan, you may remedy any errors and adjust to changing conditions.

12. Seek Professional Advice

The advice of financial planners or consultants may be beneficial when making complex financial decisions or investments. These experts can offer professional advice catered to your unique financial situation and goals.

Seeking expert counsel can help you make informed decisions and maximize your financial plan, whether you’re thinking about further education, investing strategies, retirement planning, or debt management.

Conclusion

A successful career journey requires sound financial planning. You may develop a strong foundation for financial security by establishing clear financial goals, making a reasonable budget, setting up an emergency fund, managing your debt responsibly, and investing for the long term.

A thorough financial plan must also include consideration for and use of employment benefits, income and asset protection, and preparation for significant life events. Keep in mind that financial planning is dynamic and must be reviewed and modified on a regular basis to take into account changes in your life and work. You may successfully navigate your career path and create a secure and wealthy future with careful financial planning.

[…] As the glow of the holiday season fades and the calendar turns to a brand new year 🎉🎆, this transition uplifts your spirit of new beginnings and fresh career start. Now you want to shift focus in finding your first job and the pursuit of your dream career. […]